Best Website Designing Company in Meerut

Website Designing Company in Meerut – Custom, Responsive, & Professional Designs

Having a well-designed website is key to growing your business online. If you’re looking for a top Website Designing Company in Meerut, we are here to help you create a stunning and functional website that works for your business. Our team of website designers in Meerut and web developers in Meerut specialize in building websites that are user-friendly, mobile responsive, and search engine optimized.

Whether you’re a small business in Meerut, a startup, or a larger company, we offer a wide range of services to help your business succeed online. From basic websites to eCommerce websites and SEO services, we have the skills and experience to meet your needs.

About Bala Infotech: Your Trusted Website Designing Company in Meerut

At Bala Infotech, we are proud to be recognized as a leading Website Designing Company in Meerut, known for delivering creative and results-driven web solutions. With years of industry experience, our expert team designs visually stunning and highly functional websites that help your business make a powerful digital impression.

As a trusted web development company in Meerut, we offer customized website solutions that cater to the unique needs of businesses of all sizes. Whether you’re a growing startup or a large enterprise, we’ve successfully collaborated with clients from diverse sectors to build websites that are not only beautiful but also optimized for performance and user experience.

Our commitment to excellence drives us to go beyond expectations, maintaining high standards in design, development, and client support. From elegant portfolio sites to robust e-commerce platforms, Bala Infotech ensures your online success with tailored solutions that truly deliver.

Explore Our Other Services with Web Development

Bala Infotech, India’s leading digital marketing agency, specializes in Website Development, SEO, Social Media Marketing, PPC Advertising , and more. We enhance your online presence, drive traffic, and boost ROI with expert Web Application Development, Graphic Design, and Content Marketing. Elevate your brand with us in the digital landscape.

Website Development

Transform your online presence with custom website development that captivates, converts, and elevates your brand’s digital impact.

Search Engine Optimization

Boost your website’s visibility and drive organic traffic with expert SEO strategies tailored to rank you higher on Google.

Social Media Marketing

Engage your audience and grow your brand with targeted social media marketing that drives results across all platforms.

Graphic Design

Create stunning visual content with professional graphic design that captures attention and strengthens your brand identity.

Pay Per Click Advertising

Maximize ROI with targeted Pay Per Click advertising that delivers immediate traffic and high-converting leads.

Content Marketing

Drive engagement and build trust with strategic content marketing that resonates with your audience and boosts brand loyalty.

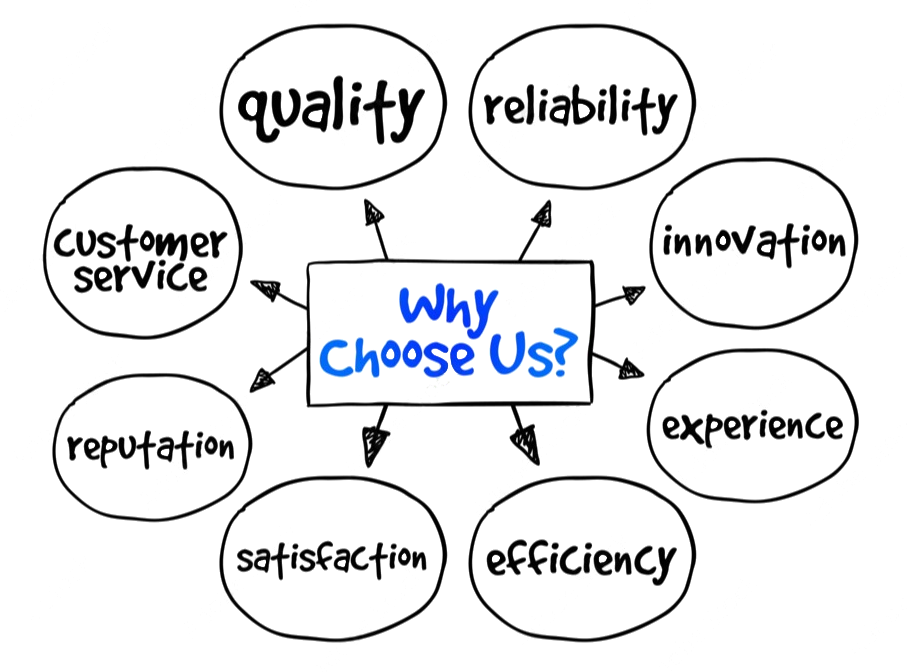

Why Choose Bala Infotech – Your Trusted Web Designing Services in Meerut

Experience & Expertise:

Bala Infotech is a trusted website designing company in Meerut with years of experience in the industry. We have successfully completed hundreds of projects, creating websites that help businesses grow online. Our team stays up-to-date with the latest design trends, ensuring that your website remains modern and competitive.

Client-Centric Approach:

We believe in understanding our clients’ goals before designing any website. Our approach involves constant collaboration with you to ensure your vision is brought to life. We focus on creating websites that provide value to your customers while achieving your business objectives.

Innovative Solutions:

Our team uses the latest design tools and technologies to craft websites that are not only visually appealing but also function seamlessly. Whether it’s custom designs, eCommerce solutions, or content management systems (CMS), we offer innovative solutions that work for your business.

Trusted Reputation:

We have built a reputation as the best web development services in Hapur, Meerut, Ghaziabad (Uttar Prasesh) by consistently delivering high-quality websites. Our clients trust us to bring their ideas to life, and we pride ourselves on offering exceptional customer service and support throughout the project lifecycle.

Affordable & Scalable:

Bala Infotech offers flexible pricing options, ensuring that your website is built within your budget. Whether you’re a startup or a large organization, we provide scalable solutions to fit your needs and future growth.

Key Features of Our Web Designing Services

Our website designing services ensure that every website we design is high-performing, user-friendly, and visually appealing. Here are the key features that set us apart

Mobile-Responsive Design

Your website will adapt perfectly to all devices, ensuring a seamless experience on desktops, tablets, and smartphones.

Custom & Creative UI/UX Design

We create modern, eye-catching designs tailored to your brand identity and audience preferences.

SEO-Friendly Structure

We build websites with proper meta tags, fast loading speeds, and SEO-friendly code to improve search rankings.

Fast Loading Speed

Slow websites lead to lost customers. Our optimized designs ensure your site loads in seconds.

User-Friendly Navigation

Easy-to-use menus and intuitive layouts enhance user engagement and keep visitors on your site longer.

Conversion-Focused Design

Designed with lead generation in mind, our websites help turn visitors into customers.

Ready to Make Your Vision a Reality?

Are you ready to turn your ideas into reality? At Bala Infotech, we’re passionate about helping you achieve real, measurable success. Whether you’re an ambitious entrepreneur, an innovative thinker, or someone driven by passion, we’re here to support you every step of the way.

Our dedicated team is committed to transforming your vision into extraordinary results. We believe in the power of collaboration and innovation, ensuring your goals are at the forefront of our efforts. Together, we can embark on a journey to create something truly remarkable.

With our expertise combined with your vision, the possibilities are endless. Don’t hesitate—let’s connect and start building something amazing today!

Get in Touch with Us!

Why We Are Perfect for You

At Bala Infotech, we believe that your website is more than just a digital presence; it’s an extension of your brand. As a website designing company in Meerut, we understand the local market and tailor our designs to suit the needs of businesses in the area. Whether you’re a local business looking to establish an online presence or an established company aiming to rebrand, we have the expertise to help you succeed.

Tailored Web Design:

Each business is unique, and so is each website we design. Our team takes the time to understand your business and target audience, ensuring your website’s design aligns with your brand identity and business objectives. We create custom websites that enhance your customer experience, whether through easy navigation, responsive design, or optimized performance.

SEO-Friendly Design:

A great website isn’t just about looks – it’s about performance too. We focus on website designing in meerut that are SEO-friendly, ensuring your website ranks well on search engines and attracts organic traffic. From page load speed to content structure, we optimize every aspect of your website for better visibility and performance.

Responsive Design:

With mobile internet usage on the rise, having a responsive website is crucial. We design websites that are fully responsive, ensuring your site looks great and functions perfectly on all devices, from desktops to smartphones.

Comprehensive Support:

Once your website is live, we don’t just disappear. Bala Infotech offers ongoing maintenance and support to ensure your website stays updated, secure, and optimized. We are always available to assist with any updates or issues that may arise, ensuring a seamless online experience for your business.

Successful Case Studies:

Over the years, we have worked with a diverse range of clients, from small local businesses to large corporations. Our success stories include boosting online visibility, improving customer engagement, and driving sales through our expertly designed websites. Our clients often return to us for new projects, proving our commitment to delivering exceptional results.

Bala Infotech stands out as the website designing company in Meerut because of our attention to detail, client-first approach, and dedication to creating high-quality, effective websites that align with your business goals.

What Our Clients Say

You Can See Our Clients Feedback What You Say?

people also search for

We hope these questions and answers help you find the best digital transformation partner for your business.

We combine years of experience with a client-centric approach to deliver custom, user-friendly, and SEO-optimized websites. Our focus on quality and innovation sets us apart.

The cost varies depending on the complexity and features of the website. We offer flexible pricing tailored to your needs, ensuring quality without exceeding your budget.

Yes, we specialize in website redesigns. We evaluate your current website and implement improvements to enhance its design, functionality, and SEO performance.

Yes, we ensure that all our websites are SEO-friendly, and we also offer comprehensive SEO services to help you improve your website’s ranking on search engines.

The timeline depends on the complexity of the project. Typically, we aim to deliver a fully functional website within 4-6 weeks.

Yes, all our websites are designed to be responsive, ensuring they provide an optimal user experience on any device, including smartphones and tablets.

Yes, we offer ongoing maintenance services to ensure your website stays secure, updated, and optimized for performance.

Yes, we specialize in designing eCommerce websites that are user-friendly, secure, and designed to convert visitors into customers.

Absolutely! We provide easy-to-use content management systems (CMS), allowing you to make updates and changes to your website as needed.

Simply contact us through our website or give us a call to schedule a consultation. We’ll discuss your project requirements and start creating a plan for your website.